Navigating The Ups and Downs Of The US Stock Market

Introduction:

The US stock market is a dynamic and ever-changing landscape that offers great opportunities for investors, but it can also be a source of uncertainty and volatility. Understanding how the stock market works and developing effective strategies is crucial for investors looking to make informed decisions and achieve their financial goals. In this article, we will explore the intricacies of the US stock market, discuss key factors influencing its performance, and provide valuable insights to help you navigate this complex terrain.

I. Overview of the US Stock Market

The US stock market, often referred to as Wall Street, is the largest and most influential stock market in the world. It comprises various exchanges, including the New York Stock Exchange (NYSE) and the Nasdaq Stock Market, where stocks of publicly traded companies are bought and sold. The stock market serves as a platform for companies to raise capital by selling shares to investors, and it provides individuals with an opportunity to invest in these companies and potentially earn returns.

II. Factors Influencing the Stock Market

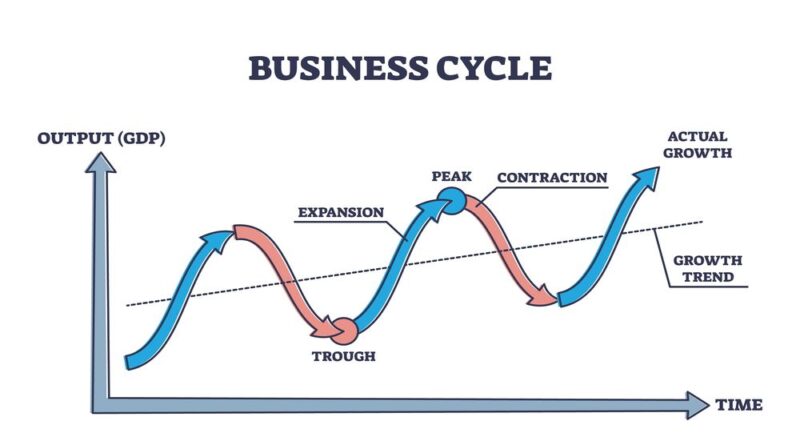

- Economic Indicators: The performance of the stock market is closely tied to the overall health of the economy. Indicators such as gross domestic product (GDP), employment data, inflation rates, and interest rates can significantly impact stock prices. Positive economic data often leads to bullish market sentiment, while negative data can trigger a bearish outlook.

- Corporate Earnings: The financial performance of individual companies plays a vital role in stock market movements. Strong earnings reports and positive outlooks can drive stock prices higher, while disappointing results may cause stock prices to decline. Investors closely monitor corporate earnings to assess the value and growth potential of companies.

- Geopolitical Events: Geopolitical events, such as political instability, trade disputes, or geopolitical tensions, can have a substantial impact on the stock market. These events introduce uncertainty and can create volatility in the market as investors react to changing circumstances and adjust their investment strategies accordingly.

- Monetary Policy: Decisions made by central banks, particularly the Federal Reserve in the United States, can significantly affect the stock market. Changes in interest rates and monetary policy decisions influence borrowing costs, liquidity levels, and investor sentiment, all of which impact stock prices.

III. Strategies for Successful Investing

- Long-Term Investing: Investing in the stock market with a long-term perspective has historically yielded positive results. By focusing on solid companies with strong fundamentals and staying invested over an extended period, investors can benefit from the power of compounding and ride out short-term market fluctuations.

- Diversification: Spreading investments across different sectors, industries, and asset classes can help mitigate risk. Diversification reduces exposure to any single company or sector, ensuring that potential losses in one area are offset by gains in another.

- Fundamental Analysis: Conducting thorough research and analysis of a company’s financial health, competitive positioning, and growth prospects is crucial before making investment decisions. Fundamental analysis involves evaluating factors such as earnings, revenue, cash flow, and industry trends to determine a stock’s intrinsic value.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. By consistently buying stocks over time, investors can take advantage of market downturns and benefit from potential long-term gains.

Conclusion:

The US stock market provides investors with a platform to participate in the growth of various companies and potentially earn substantial returns. However, investing in the stock market requires careful consideration, patience, and a long-term perspective. By understanding the factors that influence market movements and implementing sound investment strategies, investors can navigate the ups and downs of the US stock market and work towards achieving their financial objectives.