Mastering The Ebb And Flow: Liquidity Management In Banks

Liquidity management is a crucial aspect of bank operations. It involves predicting future cash inflows and outflows and building forecasts based on these predictions. It also includes monitoring accounts payable and receivable processes. It also requires testing contingent funding sources and ensuring their availability. Accurate liquidity management enables companies to avoid business risks that can disrupt their financial health and lead to insolvency. It also helps them speed up larger strategic decisions.

Cash Flow Forecasting

The more accurate your cash flow forecast is, the better your liquidity management in banks decisions will be. A robust forecast can also help you negotiate terms with investors and lenders. If you can demonstrate that you have a solid plan for managing cash burn, they’ll be more likely to trust you with their investments and lending funds. Depending on your business needs, you can use either direct or indirect forecasting methods. Both have advantages and disadvantages, so choose one that suits your organization’s needs. Direct forecasting uses transactional data that is updated daily or weekly, while indirect forecasting is based on projections and income statements.

Both methodologies produce forecast schedules of projected cash receipts and disbursements. The receipts schedule projects expected payments from customers and other cash inflows, including interest, dividend payments and tax repayments. The disbursement schedule estimates cash outflows for purchases, payroll, taxes and debt repayments. The length of the forecast varies; 13-week forecasts are most useful for cash flow planning, while longer-term forecasts may be more appropriate for budgeting and assessing long-term growth strategies.

Receivables management

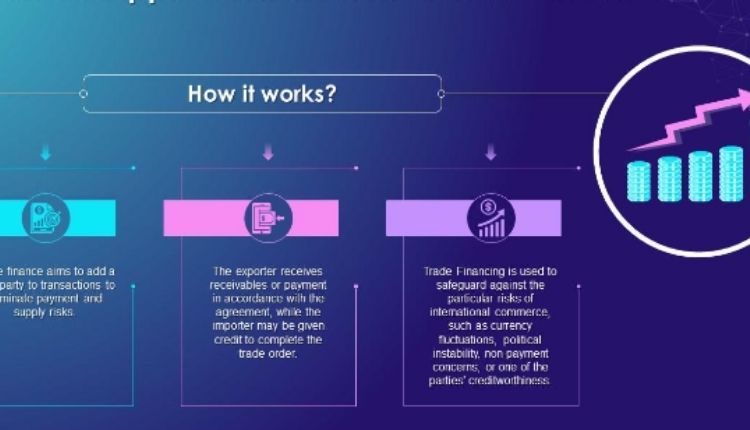

Managing receivables is crucial for all businesses that sell products and services on credit. This process includes evaluating the creditworthiness of a client, defining credit sale terms, and developing an effective receivables collection process. It also involves monitoring the aging of receivables, which can help reduce bad debts and improve cash flow and profitability. The process of managing accounts receivable starts before the sales are made, when a company decides whether to offer credit sales to a particular client. This decision is based on the customer’s creditworthiness, requirements and previous due payments. Finance professionals also evaluate the exact credit amount and period that will be available for customers to minimize credit risk.

Extending payment options to customers is a great way to encourage them to pay on time. However, it is important to monitor these payments closely. This will allow you to identify any discrepancies and take corrective action if needed. Also, offering different methods of payment will help you reduce the costs associated with processing these payments.

Automated Cash Flow Tracking

Automated cash flow tracking makes it easier for businesses to access up to date data on their finances. It also helps them detect and correct any issues that could affect their financial performance. This can help them reduce expenses and improve their profitability. A centralized view of cash balances across multiple entities and currencies enables organizations to make well-informed decisions about investment and borrowing. It also allows for accurate reconciliation and allocation of bank statements, and streamlined intercompany interest settlement and tracking.

Moreover, it helps to recognise core banking service bottlenecks at an early stage so that they can plan accordingly. For example, if an organisation expects that it will have a high level of cash surpluses in the near future, it can use those funds to pay back loans and prevent an increase in interest liabilities. A good automated cash flow management solution will provide a unified view of balances and cash positions, which can be integrated with banks to import current and prior day bank files automatically and auto-populate data. It can also be used to monitor cash position projections and create forecasts.

Risk Management

In a rapidly changing banking environment, it is essential to have an effective risk management system. Banks should focus on achieving governance goals, including reducing costs and improving efficiency. The right software and experts can help them achieve these goals. LogicManager’s software and expert advisory services provide an end-to-end solution to address risk management challenges in banks. In addition to managing credit risk, banks need to manage market and liquidity risks. These include fluctuations in interest rates, changes in commodity or equity prices, hedging risk, and other external factors. These risks can cause losses and affect a bank’s financial standing and existence.

The best way to mitigate these risks is through a decentralized approach to risk management. This approach empowers departments to identify, assess, and mitigate risks without wasting time on duplicate efforts. It also allows them to recognize dependencies and design centralized controls. In addition, it reduces the likelihood of an incident and enables the organization to respond quickly when an incident occurs.

Conclusion

Effective liquidity management is the lifeblood of a bank’s financial stability and operational success. Striking the right balance between assets and liabilities ensures resilience in the face of economic volatility, positioning banks to meet customer needs and navigate uncertain financial waters with confidence.