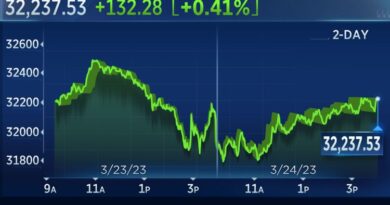

Stock Market Soars as Investor Confidence Surges: Analysis and Insights

Introduction

: The stock market experienced a significant upswing today as investor confidence reached new heights. This surge can be attributed to a combination of factors, including positive economic indicators, encouraging corporate earnings reports, and global market optimism. In this article, we will delve into the reasons behind this remarkable market performance, analyze key trends, and provide insights for investors. Additionally, we will address three frequently asked questions to provide a comprehensive understanding of the current stock market situation.

I. Factors Driving the Stock Market Surge The recent stock market rally can be primarily attributed to the following factors:

1. Positive Economic Indicators: The economy has displayed robust growth, with key indicators such as GDP, employment rates, and consumer spending surpassing expectations. The gradual recovery from the pandemic-induced downturn has provided a strong foundation for the stock market to rebound.

2. Encouraging Corporate Earnings: Companies across various sectors have reported impressive earnings in recent quarters. Many businesses have adapted to changing market dynamics, optimized their operations, and embraced digital transformations, resulting in increased profitability. Positive earnings reports have instilled confidence in investors, leading to a surge in stock prices.

3. Global Market Optimism: Global markets have witnessed favorable trends, with economies rebounding from the pandemic and international trade improving. Additionally, progress in vaccination campaigns and government stimulus measures have further boosted market sentiment. Investors have been more willing to take risks, leading to increased capital flow into stocks.

II. Key Trends and Market Analysis Examining the stock market trends provides valuable insights for investors. Here are some key observations:

1. Sector Rotation: There has been a notable shift in investor preferences, with a rotation from growth stocks to value stocks. As the economy recovers, sectors such as finance, energy, and industrials have gained traction due to their strong fundamentals and potential for growth. Technology stocks, which had dominated the market in recent years, have experienced some correction but remain attractive for long-term investors.

2. Small-Cap Outperformance: Small-cap stocks have outperformed their large-cap counterparts in the current market rally. This trend can be attributed to their potential for higher growth, reduced exposure to international markets, and the focus on domestic recovery. However, it’s important to consider the associated risks and volatility when investing in small-cap stocks.

3. Increased Retail Investor Participation: Retail investors, empowered by accessible trading platforms and social media-driven investment communities, have played a significant role in the recent market surge. Their collective action, often through viral trends and targeted stock purchases, has influenced stock prices and created market volatility. Understanding this trend is crucial for investors navigating the current market landscape.

III. Insights and Considerations for Investors While the stock market rally provides exciting opportunities, it is essential for investors to exercise caution and consider the following insights:

1. Maintain a Diversified Portfolio: Diversification remains a fundamental strategy to manage risk. Investors should spread their investments across various sectors, asset classes, and geographical regions. This approach helps mitigate potential losses and ensures exposure to different market trends.

2. Long-Term Focus: Short-term market volatility is expected, and attempting to time the market can be challenging. Instead, adopting a long-term investment strategy aligned with personal financial goals is advisable. By focusing on quality stocks with strong fundamentals, investors can navigate market fluctuations more effectively.

3. Stay Informed and Seek Professional Advice: Keeping abreast of market news, staying informed about industry trends, and conducting thorough research is crucial. Additionally, consulting with financial advisors or investment professionals can provide personalized guidance based on individual risk tolerance and investment objectives.

Conclusion: The stock market’s remarkable surge today reflects a combination of positive economic indicators, encouraging corporate earnings, and global market optimism.